Irrevocable Trust

Irrevocable trusts are critical in asset protection, estate planning, and tax avoidance planning. Thanks to the protection they provide, what once was a tool for the powerful and wealthy, irrevocable trusts are now available to everyone. Since mastering their use takes time, several estate planners don’t use Irrevocable Trusts. However, bypassing trusts as an estate planning instrument is a blunder that can easily be avoided by hiring a professional lawyer from Daniel Albert Law Firm.

What Do You Mean By Irrevocable Trust?

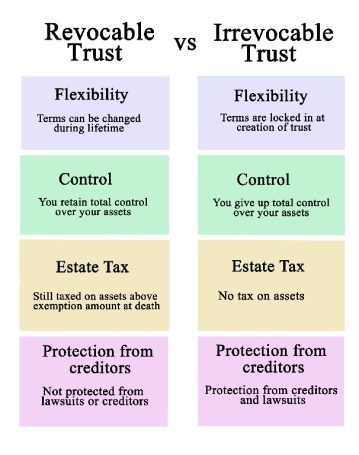

The grantor creates an irrevocable trust, enabling them to transfer certain assets from their taxable estate in the name of the trust. Once done, they cannot “revoke” the trust and bring the assets back under their name. It is a permanent status and different from a revocable trust, designed for being withdrawn at any time.

When drafted correctly, an individual can hand over their assets to an irrevocable trust to deter future creditors from taking them away. After the Grantor names their assets to the irrevocable trust, they will belong to the trust. The grantor will no longer own these assets since they pertain to the trust.

Advantages of an Irrevocable Trust

An irrevocable trust is vital in most estate and asset protection plans. It is a flexible tool that can own almost all kinds of assets while providing shelter from creditors, a divorce between the grantor and the beneficiary, or any other legal issue. A trust can help you keep all assets within the family, and if a jurisdiction has revoked the rule against perpetuities, it can last forever. Creating an irrevocable trust provides benefits for generations.

These valuable benefits result from a grantor transferring their assets to the trust. They surrender all cases of ownership over those assets. Such a property transfer can also remove these assets from the taxable estate, helping one avoid death taxes and taking the income tax burden away from the grantor.

Do You Need A Lawyer?

Almost all irrevocable trusts require the grantor to hire a skilled estate planning attorney to provide professional advice and represent them in court.

If you are looking for expert guidance, we suggest retaining a skilled attorney since it is wise to let a specialist handle such legal situations. Professional legal counsel by an experienced trust lawyer from Daniel Albert Law Firm will help you avoid any conflicts while minimizing the overall chances of litigation. Furthermore, our professionals will also help reduce the risks of mistakes that may cause personal liability.

Are you are looking for a professional lawyer to help you regarding your irrevocable trust. Well, in that case, we have a team of qualified and knowledgeable attorneys who will be more than happy to assist you. Here at Daniel Albert Law Firm, we have over 15 years of experience working in the field and handling clients like yourself. Give us a call at 832-930-3059 to get started right away.